Stocks and Mutual Funds

The Share Market:

Let's assume company Hero MotoCorp requires capital (money) from public to make products. The profit/loss on your investment into their company depends on their profit/loss in the market

Stocks:

Penny Stocks:

You lend money to your friend. The chances of getting your money back is 50%, depends if he is honest or not. Similarly few companies might go bankrupt and you could lose all your money due to internal disorganized structure of the company. The chances of gaining profit is below 5% in this. These are generally penny stocks.

For Example:

1) VI ( Vodafone Idea ), the company already running in debt and lost millions of customers to Airtel and Jio. The share price is below 10 ₹ as of now.

2) Ballarpur Paper Industries ( BILT), Chandrapur. - This company used to export paper to America for dollar currency notes a long time ago. Now it has lost it's charm and business. Hence it's share price hovers around 1.10 - 1.15 ₹ and is a penny stock.

Midcap and Large cap Industries:

Since these follow disciplined financial practices and are market proven, there shares are time tested.

As we lend money to the person only after knowing his background history and the current situation. Same goes with you buying the shares.

Mutual Funds:

You lend money to your 5 friends to invest in their respective businesses with a condition that they would share a portion of profit/loss after sale;

5 Friends: Akash, Bubbly, Chandu, Daisy, Evan

Akash, Bubbly are rich and have good profitable businesses

Chandu and Daisy are okayish rich with profit good enough to speak of.

Evan's business is seasonal.

Now we could categorize as:

Akash, Bubbly: Large cap funds (named A fund)

Chandu and Daisy: Mid cap funds (named B fund)

Evan: Small cap funds (named C fund)

While A fund would definitely give profit (far better than typical FD in bank), there needs a long term investment generally.

Same goes with Fund B (medium to long term investment)

Fund C might bear fruits in short term but not good for long term as it gets affected by the market climate.

Difference between stocks and mutual funds:

While in stocks you lend money to Akash 1000 ₹, if he loses you definitely lose money.

In Mutual funds, you lend money to Fund A (Akash, Bubbly) 1000 ₹ i.e., 500 ₹ each. Suppose Akash has a lose of 10% and Bubbly is in profit of 20% , you are in profit of 20-10= 10% overall on 1000 ₹.

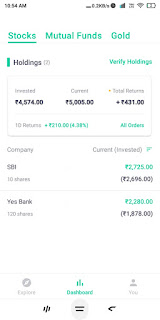

Pic for reference:

As RBI is increasing the limit for tap and pay through card transactions from 1st Jan 2021 and SBI is a public company high chances there would be surge in share price.

As Yes bank's management has been changed and the stake is bought by other banks with good records. It has shown a steady growth and will hopefully come into mainstream again.

Below is the screenshot for reference:

You could see that the return in 2 Days is ₹ 431 as Yes bank share price increased from ₹15 to ₹19 per share.

Investment:

Pros:

- The interest on Mutual Funds gets compounded annually. That means if for the first year you get 10% interest on 1000 ₹ it becomes 1100 ₹ at year end. For the second year, you will get 10% interest on 1100 ₹ so on and so forth.

- Investing in Stocks and Mutual funds restricts you from over spending, that's a double benefit.

- People lost jobs during pandemic as their companies couldn't afford to pay salaries. This is because they didn't have money due to no sales. IT employees constitute 4 Million people in India and the people who have money could invest money in share market. Then companies would get money to run businesses and they will employ the people again. So in short it is also a social work.

- You would get addicted to earning.

- The reason we don't get this in school is; we have been taught to get job being in comfort zone rather than taking calculated risk and be creative. So you would learn more while growing into share market sector.

Cons:

- "Mutual Funds are subject to Market risk" - as the saying goes. Market risk depends on unprecedented incidents such as

- National Emergency

- Financial Depression

- Pandemic

- Inflation

- Over dependency on brokers

- Poor learning on investments

Investing in US Stock Markets:

In the next 5 years, it would not be uncommon for Indian people investing in US Stocks markets.

Pros:

- US Stocks market (NYSE and NASDAQ) are the largest stock markets in the world.

- They have outperformed Indian stocks market in the last 10 years.

- RBI permits resident Indians to invest up to 250,000 $ annually.

- You could buy 1/10000th part of a share i.e., you could buy tesla share for 5 ₹. However the minimum investment is 5 $ around.

- ICICI Bank account holders can invest directly through online portal. Whereas other bank customers have to visit their home branch and submit the form in person to deposit the money.

- US Brokerage account can be linked easily through apps: Vested and Winvesta

- If the Indian rupee falls against the dollar, you gain.

- Any disturbance in Indian economy would not affect the investment as it is in US brokerage account.

- The apps also provide multi currency accounts.

Cons:

- Unless you are investing large it's not worthy enough. The flat fee for deposit is 1700 ₹ (ICICI Bank) and withdrawal charges is 35$ through Winvesta; 11$ through Vested. The banks would soon reduce these charges by large if they see people investing. This could probably happen in next 3 years.

Below is the screenshot for reference:

Assuming that you invested 5000 ₹ in Dec. 2019 (1$ = 73.57 ₹ today), you would have earned 44.071 ₹ by Dec.2020.

**** End of Document ****

This is a personal research and the screenshots are of my accounts. I am yet to invest in US stocks however. As per my opinion, people would lose money in Nikola (for sure) and should gain in American Airlines.

As a saying goes and I quote:

"People in general do not fear of losing! They fear instead of losing self respect".

Wish a prosperous life by making it :). Write to me your experiences and value points.

Let's share knowledge.

Do write to me at

kiran.elkunchwar@engineer.com

No comments:

Post a Comment